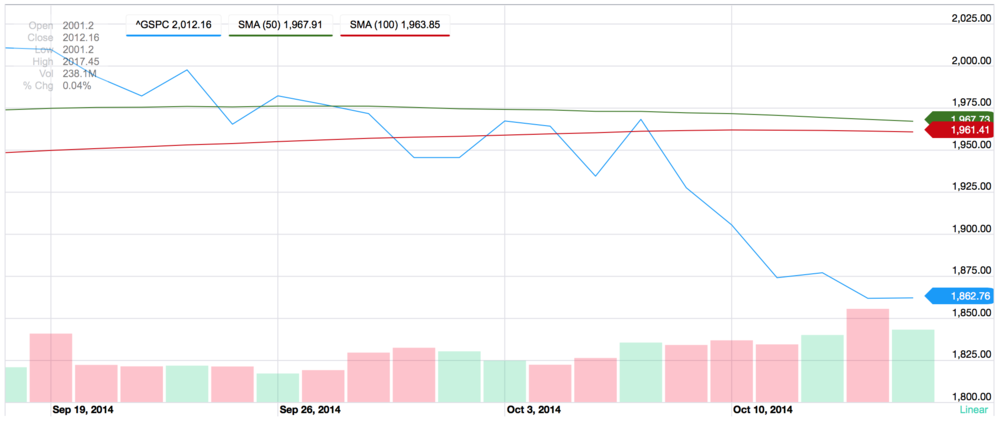

The chart above documents S&P 500 activity from September 18, 2014 to October 16, 2014. In roughly a month, the broad U.S. index moved from 2,011.36 to 1,862.76, a 7.4 percent decline. Intraday on the 16th, the index reached 1,835.02, an 8.8 percent decline, peak to trough.

The green and red lines are the 50 and 100 day moving averages, respectively. For traders these are key technical levels and when an index moves lower than the averages, that is a sell sign because momentum has changed.

There has been an increased use of technical indicators and program trading by advisors following the financial crisis. The idea of moving out of the market to miss more downside is appealing to individuals who remember how their accounts performed in 2008-2009. However, these indicators are not useful for people taking a long-term perspective and ‘home gamers’ or retail investors/average investors more often than not get these moves wrong.

So, given that the market moved from 2,011.36 in September to 1,835.02 a few weeks ago, broke through key technical levels and that the Federal Reserve ended quantitative easing on Wednesday, where would one guess that the market is today? Well…

As of this morning, the S&P 500 not only gained back all the losses over the last few weeks, but set another all-time intraday high.

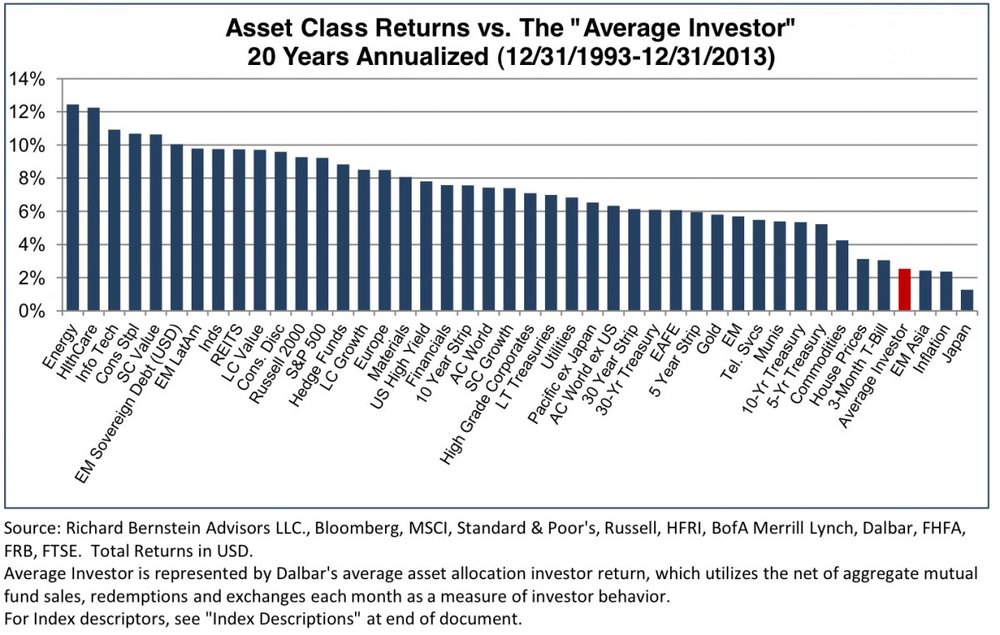

Below is a chart of average investor returns for a 20-year period that incorporates aggregate retail mutual fund sales, redemptions and exchanges to measure investor behavior. The chart is from a post by Business Insider and courtesy of Richard Bernstein.

Assuming you’re not a day trader, what does this mean for you? Rebabalance your accounts, buy when markets are down, and be patient. When markets were down we had a chance to buy the S&P 500 index for our 401(k) clients and Disney $DIS for our managed portfolios.

When everyone else is panicking, keep calm and buy on!